Today I faced a choice. Should I go out and enjoy the beautiful weather and waves and go for a surf or should I blog about my favorite financial reporting tool? Seems like a pathetic question for a surfer to ask, or maybe this financial reporting tool is really that great. I’ll settle for an answer of “both”.

The tool in question is the Waterfall Chart. It’s a way to compare actual results across time periods (months or quarters usually) against your original Plan of Record, as well as forecasts you made along the way as more information became available. It packs a ton of information into a concise format, and provides management and Board members quick answers to the following important questions:

1. How are we doing against plan? Against what we thought last time we reforecast?

2. Where are we most likely to end up at the end of the fiscal year?

3. Are we getting better at predicting our business?

The tool works like this:

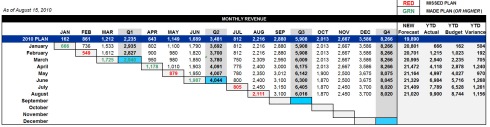

Across the top row is your original Plan of Record. This could be for a financial goal like Revenue or Cash, or an operating goal like headcount or units sold. Each column is representative of a time period. I like monthly for most metrics, with sub-totals for quarters and the full fiscal year. Each row below the plan of record is a reforecast to provide a current working view of where management thinks they will wind up based on all the information available at that time period. Click the example below which was as of August 15, 2010 to see a sample, or click the link below to download the Excel spreadsheet.

Periodic reforecasting does not mean changes to the official Plan of Record against which management measures itself. Reforecasts should not require days of offsite meetings to reach agreement. It should be something the CEO, CFO, and functional leaders like the VP Sales or Head of Operations can hammer out in a few hours. Usually these reforecasts are made monthly, about the time the actual results for the prior month are finalized. When you have an actual result, say for the month of August, $2,111 in the example above, this goes where the August column and August row intersect. On that same row to the right of the August actual you will put the new forecasts you are making for the rest of the year (September through December.) In this fashion, the bottom cells form a downward stair step shape (a shallow waterfall perhaps?) with the actual results cascading from upper left to lower right. You can get fancy and put the actuals that beat plan in green, and those that missed in red. You can also add some columns to the right of your last time period to show cumulative totals and year to dates (YTD). With or without these embellishments you’ve got some really powerful information in an easy to visualize chart.

Two questions an entrepreneur might ask about this tool:

By repeatedly comparing actual to plans and reforecasts, won’t my Board beat me up each month if I miss plan or even worse, miss forecasts I just made? If you are a relatively young company, most Board’s (I hope) understand that planning is a best-efforts exercise not an exact science. Most Boards will react rationally and cooperatively if you miss your plan, as long as you avoid big surprises. By giving the Board updated forecasts you decrease the odds of big surprises because the latest and best information is re-factored in to the equation as the year progresses. They probably won’t let you stop measuring yourself against the Plan of Record, but at least you’ve warned them as to how results are trending month to month and course corrections can be made throughout the year.

Won’t this take a lot of time? Hopefully not a ton, but it does take effort. However, it should be effort well worth it beyond just making the Board happy, because as a management team you obviously care about metrics like cash on hand, and this should be something you are constantly recalibrating anyway. The waterfall is the perfect tool to organize and share this information.

Most of my companies using this tool track five to ten key metrics this way. Typical metrics include:

- Revenue

- New bookings

- Cash on hand

- Operating expenses

- Net income

- Headcount

- Units sold or new customers acquired

- Some measure of deployed/live customers (if there is a lag between a sale and a live customer)

- For internet companies, some measure of the “top of the funnel” such as Unique Visitors or Page Views

Whether or not you agree this is the single greatest financial reporting tool ever, I hope you give it a try and find it useful. Now I’m going surfing….

Brian,

This post and the spreadsheet are both rocking.

Would you mind posting a way to download a sample version of this spreadsheet?

Best,

David

yes, I’ll figure something out. the formulas are really simple. Just addition.

Indeed, very simple but posting them online will save a lot of non-excel jockeys a lot of time.

Thanks!

David

Just uploaded the spreadsheet. Thanks for the suggestion.

Yup. Hate doing that crap. That’s why I started 60mo, so I don’t have to pray that my excel formulas don’t break.

cool. I have to check this out.

Great post, Brian, and I agree fully! Too often companies view their plan as static and always forecast the plan numbers even deep into the year, which suggests that we have no new information or insights. The other extreme of constantly changing the “plan of record” and not being intellectually honest about changes is also problematic. This is an under used “best of both worlds” answer.

Reblogged this on The Business of Social Media and commented:

This is a tool that was recommended to me and I plan to start using immediately. Recommend for anyone who seriously wants to manage their business and cash flow.

Hi Brian,

I just stumbled across this and am finding it incredibly useful! This may be a really stupid question, but how do you get to the reforecasted figure? Is there a formula or is it an educated guess? For example the January figure of 736 under the February column, how did you get to this? Thanks, E

This is an educated guess or “current working view” from the executive team, usually the CFO and VP of Sales. It is based on more recent information than the original plan, or prior forecast, so it should hopefully more closely predict the final outcome than either of those prior estimates.

Hi Brian

I know you posted this a long time ago…blame the long tale of the internet but i was looking at different reporting ways to present a narrative and found this spreadsheet. This may be a stupid question but i have been trying to figure out the math for the F7 march /January intersection -1533 . I understood updating your forecast in F8 but that number in F7 i though should have been a calculation rather then imputed manually. what am i missing here and hope your still surfing!

Good question: let’s say the Plan of Record was finalized sometime in Q4. That is Row 6, the Plan of Record. Row 7 is the January forecast. It does not really matter weather it’s early January, or late January, as long as you have new information and updated assessment of the future periods, in this case, on how March will go. What my particular examples shows is that the January re-forecast assumes some deals will slip from February into March vs the original Plan of Record. Pretty typical for deals to slip to the end of the quarter. Make sense?